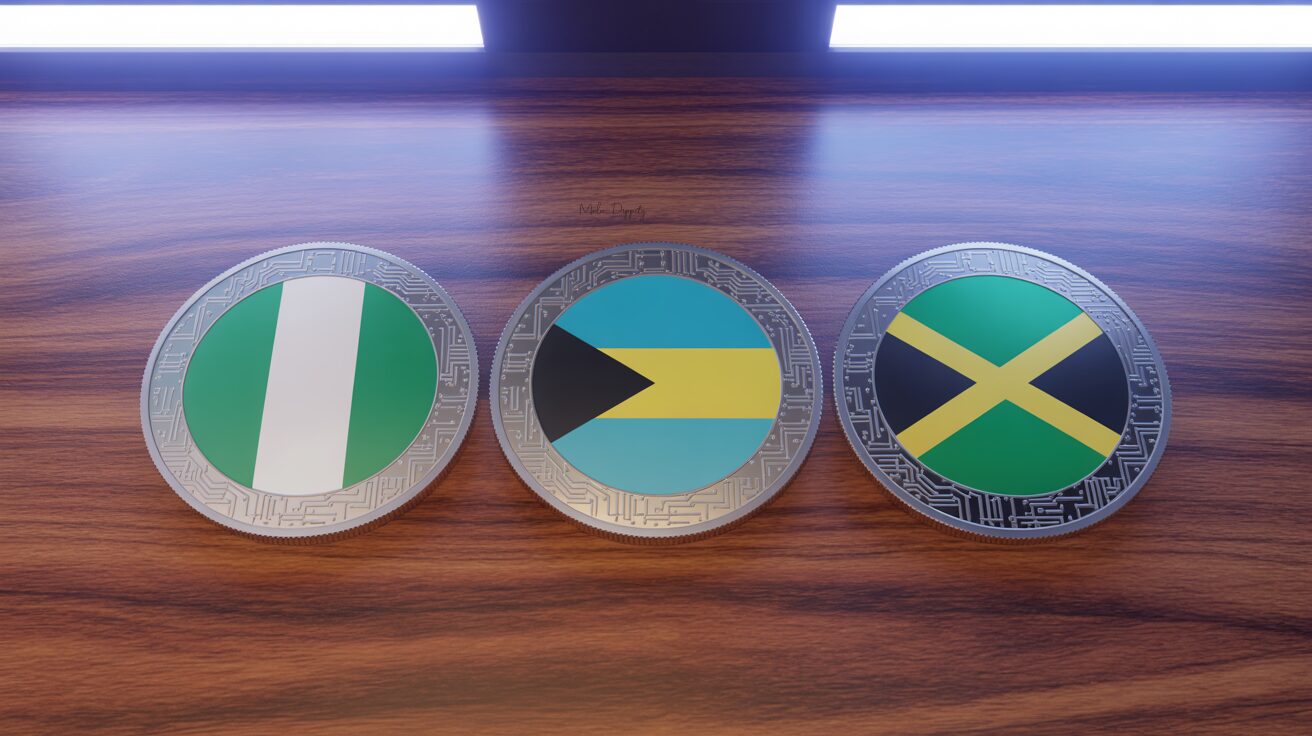

In my last post, I reviewed the progress of Central Bank Digital Currencies (CBDCs) across the globe. This time we want to take a look at the specific countries that have implemented fully functional CBDCs. In this post I will explore the CBDCs implemented for Nigeria, The Bahamas, and Jamaica. Wanna know how it’s going? Let’s chat.

What’s up with Nigeria’s CBDC?

Nigeria’s CBDC is known as the eNaira and it was introduced in October 2021. Despite an aggressive push, the eNaira hasn’t seemed to catch on. To help with adoption, Nigeria put strict controls on cash withdrawals from banks and ATMs and banned cryptocurrency banking for a while. As of 2023, eNaira adoption was less than 0.5% and most wallets were inactive. With enthusiasm for the eNaira being rather low, Nigeria’s central bank is starting to look at how to utilize stablecoins.

How about The Bahamas?

Introducing its Sand Dollar in October 2020, The Bahamas boasts having the world’s first CBDC. Despite the head start, the Sand Dollar is not catching on widely with only about 1% of residents utilizing the Sand Dollar. While the country is directing banks to help push the digital currency, many banks may find that issuing the Sand Dollar conflicts with maintaining deposits that would be utilized for lending.

And Jamaica?

The Jam-Dex is Jamaica’s CBDC. While the Jam-Dex has been available since July of 2022, Jamaica currently has just one bank issuing it. There is concern that not enough merchants have systems for accepting the Jam-Dex. However, CBDC usage has grown amongst people using it for payments from person to person. The central bank is still committed to making Jam-Dex work as they believe that there are savings with the digital money over the cost of having to secure physical money.

Explore More

Is Nigeria’s eNaira Dead? CBN Forms New Task Force for Official Stablecoin

‘Sand Dollar’ Isn’t Taking Off in Bahamas; Central Bank Tightens the Screws

Leave a Reply